IC 01 Sample Papers : Have you enrolled for III’s Principle of Insurance exam? If yes, then we have 100+ Important questions that can help get you an overall idea of the upcoming test. All the Questions i here currently do not have answers mentioned but they’ll be added in the near future. For now you can either attempt or google the answers using the sample paper.

Licentiate by Insurance Institute Of India is a certificate based degree that helps you get jobs, promotions and even incentives in the insurance sector. If you are an employee in an Indian insurance company, this degree is a must as the benefits of this will last even after retirement.

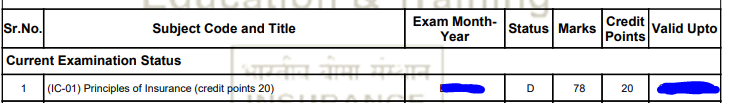

All the Questions mentioned here are collected from the official IC 01 Book as well as the recent Licentiate exams conducted by III. I have successfully cleared this paper on the first attempt, as you can see in the image.

I’ll also be sharing my personal method that got me this exam cleared. Look for that while you analyze this unsolved sample paper.

1. Which of the following statements is true?

1. Insurance is a method of sharing the losses of a ‘few’ by the ‘many’

2. Insurance is a method of transferring the risk of an individual to a group of individuals

a) Only Statement 1

b) Only Statement 2

c) Both Statement

d) Neither of the Statements

2. In the insurance context ’risk’ means

a) Possibility of loss or damage

b) Loss producing event

c) Property covertly covered by

insurance

d) All the above

3. To which of the following does the Employees state insurance Act,

1948 apply.

a) Employees of Central

Government

b) Employees of State

Government

c) Employees of Public Sector

manufacturing companies

d) Industrial employees as

notified by the Government

4. Which of the following statements is true?

a) Insurance protects the asset

b) Insurance prevents its loss

c) Insurance reduces

possibilities of loss

d) Insurance pays when there is

loss of asset

5. Which of the following statements is true?

a) Insurance facilitates free

investment of capital in business

b) Insurance encourages

commercial and industrial

development

c) Insurance contributes

commercial and industrial

development

d) Insurance contributes to

national productivity

e) All the three above

6. The duty of disclosure of material information

a) Applies to insured

b) Applies to the agent

c) Applies to the insurer

d) All three

7. Out of 400 houses, each valued at Rs.20,000. 4 houses get burnt

every year on an average resulting in a loss of Rs.80,000. What should

be the annual contribution of each house owner to make good this loss?

a) Rs.100

b) Rs.200

c) Rs.80

d) Rs.400

8. Which of the following statements is true?

1. Insurance provides direct benefits to individuals

2. Insurance provides indirect benefits to the community

a) Only Statement 1

b) Only Statement 2

c) Both Statements

d) Neither of the Statements.

9. Which of the following statements is true?

1. Insurance prevents the losses from happening

2. Insurance spreads the losses amongst the insured

a) Only Statement 1

b) Only Statement 2

c) Both Statements

d) Neither of the Statements.

10. Which of the following are requisites of a valid insurance contract?

1) Consideration 2) Parties of the same mind

3) Parities are competent of contract

a) 1

b) 2

c) 1 and 2

d) All three

11. Which of the following statements is correct according to law?

1. The parities to a commercial contract have to observe good faith

2. The parties to an insurance contract have to observe utmost good faith

a) 1 is correct

b) 2 is correct

c) Both are correct

d) Both are incorrect

12. Which of the following statements is correct?

1. A void contract has no legal validity

2. A violable contract remains a contract until the insurer exercises his

option to avoid the contract

a) 1 is correct

b) 2 is correct

c) Both are correct

d) both are incorrect

13. If there is no insurance interest the insurance contract becomes

a) Unenforceable in a Court of

Law

b) illegal

c) Void

d) avoidable

14. Which of the following makes the contract unenforceable in a Court

of Law?

a) The proposer has committed

non- disclosure

b) The proposer has committed

mis- representation

c) The proposer has given

wrong address of property due

to a clerical error

d) The policy is not stamped as

per Indian Stamp Act.

15. The object of the principle of indemnity is to

a) Pay the full cost of repairs

b) Pay the full cost of

replacement

c) Pay the cost of reinstatement

d) Prevent the insured form

making any profit out of his loss

16. Sum insured under an insurance policy means

a) It is the agreed value of

subject matter insured

b) The amount payable when

there is a loss

c) The amount on which the

premium is calculated

d) The maximum limit of liability

under the policy

17. Agreed Value policies are issued for

a) Marine cargo

b) Marine hull

c) Marine cargo and hull

d) Fire insurance on high valued

machinery

18. Which of the following ensure that the amount of claim payable is

less than the actual amount of loss.

a) Pro-rata average

b) Excess limit

c) Salvage

d) All the three above

19. Consent of insurers is not required for the assignment of

a) Marine hull policies

b) Marine cargo policies

c) Fire policies

d) Burglary policies

20. Subrogation condition does not appear in

a) Fire policy

b) Marine cargo policy

c) Burglary policy

d) Baggage policy

21. Which of the following statements is correct?

1. Subrogation under common law is implied in contracts of indemnity.

2. Subrogation under common law arises only after payment of loss

a) 1 is correct

b) 2 is correct

c) Both are correct

d) Both are incorrect

22. Insurable interest in not always required at the time of taking the

policy.

a) Fire insurance

b) Marine hull insurance

c) Marine cargo insurance

d) Burglary insurance

23. Proximate cause has to be selected

a) When two or more causes

operate simultaneously

b) When two or more causes

operate on after another

c) When insured peril and

excluded peril operate together

d) All there above

24. If an insurance policy is not stamped as per Indian Stamp Act, the

contract becomes

a) Illegal

b) void

c) Void able

d) Unenforceable in a Court of

Law.

25. Which of the following does not affect the amount of loss payable

under the policy?

a) Breach of utmost good faith

b) Salvage

c) Pro-rata average

d) Excess clause

26. Which of the following statements is correct?

1. Subrogation does not arise in personal accident insurance.

2. Contribution does not arise in personal accident insurance

a) 1 is correct

b) 2 is correct

c) Both are correct

d) neither is correct

27. Insurance contracts are not gambling transactions because

a) They are based on insurable

interest

b) The policy is stamped

c) Full premium is paid

d) All material facts are

disclosed

33. Which of following statements is true.

1. The proposer need not disclose facts which he considers as not

material.

2. Facts which are of common knowledge need be disclosed.

a) 1 is true

b) 2 is true

c) Both 1 and 2 are true

d) both are false

34. The contractual duty of utmost good faith applies

a) To motor insurance only

b) To marine cargo insurance

only

c) To fire insurance only

d) All insurances here proposal

form with a declaration clause is

used

35. Which of the following is an evidence of insurance contract?

a) Payment of premium

b) Acceptance of proposal

c) Insurers’ prospectus

d) policy of insurance

36. The principle of utmost good faith requires the proposer to disclose

material facts

a) Which he knows

b) Which he ought to know

c) Which he knows and ought to

know

d) None of the above

37. Transfer of rights and liabilities of an insured to another person who

has insurable interest is known as

a) Consideration

b) Subrogation

c) Assignment

d) Endorsement

38. In which of the following policies the principle of indemnity is

modified.

a) Fire Declaration policy

b) Fire Floating policy

c) Fire Reinstatement policy

d) Fire loss of profits policy

39. The legal right to insure means

a) Consideration as per Indian

Contract Act.

b) Competence as per Indian

Contract Act.

c) Assignment

d) Insurable interest

40. An insured cannot recover more than his actual loss because of

a) Under- insurance

b) excess clause

c) Principle of indemnity

d) franchise clause

41. In which of the following insurances the principle of indemnity is

modified.

a) Public Liability

b) Fidelity Guarantee

c) Marine Cargo

d) Baggage Insurance

42. The principle of indemnity arises under the

a) Insurance Act 1938 (as

amended)

b) IRDA Act

c) Indian Contract Act

d) Common Law

43. Which of the following principles prevents an insured form making a

profit out of his loss.

a) Proximate cause

b) Pro-rata average

c) Indemnity

d) Insurable interest

44. How much is the amount of claim payable, if sum insured is Rs. 2

lakhs, the ‘excess’ limit is Rs.20,000/- and the loss is Rs.25,000/-.

a) Rs.20,00

b) Rs.25,000

c) Rs.15,000

d) Rs.5000

45. Which of the following statements is true?

1. Marine Cargo policies are valued policies

2. Marine Hull policies are valued policies

a) 1 is true

b) 2 is true

c) Both are false

d) Both are true

46. Which of the following is not a contract of indemnity in the strict

sense.

a) Mediclaim insurance

b) personal accident insurance

c) Fidelity guarantee

d) Burglary insurance

47. The principle of subrogation applies under

a) Products liability policy

b) fidelity guarantee policy

c) Fire policy

d) All the above

48. A policy with a sum insured of Rs.1 lakh is subject to a ‘franchise’

limit of Rs.10,000/-, what is the amount payable if the loss is Rs.15,000/-

?

a) Rs.15,000

b) Rs.5,000

c) Rs.25,000

d) nil

49. Under which of the following clauses, the insured has to bear a part

of the loss.

a) Pro-rata average

b) Franchise clause

c) Excess clause

d) All the above clauses

50. When there are several policies on the same subject-matter, each

insurer pays only a proportion of the loss. This is known as.

a) Pro- rata average

b) franchise

c) Contribution

d) subrogation

51 What is the amount of claim payable if the loss is Rs.8,000 under a

policy with a sum insured of Rs. 1 lakh and excess limit is Rs.10,000/-

a) Nil

b) Rs.10,000

c) Rs.8,000

d) Rs,2,000

52. The principle of indemnity is applied through deduction

a) For under insurance

b) for depreciation

c) Under franchise clause

d) under excess clause

53. A policy with a sum insured of Rs.1 lakh is subject to a ‘franchise’

limit of Rs.10,000, what is the amount of claim payable if the loss is

Rs.5,000?

a) Rs.10,000 b) Rs.15,000

c) Rs.5,000 d) nil

My Personal Experience With IC01 :- I was introduced to Licentiate by my colleagues Few months before appearing to the exam. What I did was read the official book for few hours every day until I completed it. After that I got a hold of A ton of sample papers just like this one and solved few days before exams. That is basically it. If you want more papers, All you need to do is to show some interest in it by commenting here and I might just drop it someday. The more papers you go through, the higher of chances there are to crack the examination.

54. Which of the following statements is true?

1. Contribution applies only to contracts of indemnity

2. Contribution does not apply to personal accident

a) 1 is true

b) 2 is true

c) Both 1 and 2 are true

d) both are false

55. If a warranty is breached the policy becomes

a) Void

b) Voidable

c) Invalid

d) unenforceable in Court of

Law

56. The purpose of the proposal form is to provide forms

a) Material information

b) Declaration that the answers

are true and accurate

c) Agreement of the insured that

the form shall be the basis of

the insurance contract

d) All the above three

57. Which of the following questions is common to all proposal forms.

a) Proposer’s previous

insurance

b) Proposer’s present insurance

c) Past losses

d) All the above

58. In motor insurance Certificates of insurance are issued because

a) Make of vehicle is not known

b) Year of manufacture is not

known

c) Seating capacity is not known

d) It is required by the Motor

Vehicles Act

59. As per the IRDA Regulations in which of the following insurance,

written proposal is not necessary.

a) Fire insurance on Cargo

industrial risks

b) Marine cargo insurance

c) Compulsory public liability

d) Fidelity Guarantees

60. Certificates of insurance are issued in

a) Marine hull insurance

b) marine cargo insurance

c) Engineering insurance

d) Workmen’s compensation

insurance

61. Which of the following statements is true?

1. Endorsements are issued at the time of issuing the policy as part of

the policy

2. Endorsements are issued after the policy to record alterations

a) 1 is true

b) 2 is true

c) Both are false

d) Both are true

62. To arrive at final rate by loading the pure rate, which of the following

is not taken into account?

a) Past losses

b) Unexpected heavy losses in

the future

c) Margin for expenses of

management

d) margin for profits

63. Rate of premium is based on

a) Degree of hazard

b) variations in degree of hazard

c) Past loss experience

d) all the above

64. Which of the following is paid out of ‘pure premium?’

a) Losses

b) Agency Commission

c) Expenses of management

d) Unexpected heavy losses

65. Under IRDA guidelines which of the following policies fall under

Individual and Experience rated products.

a) Group Personal Accident

b) Group Health

c) Motor Fleets

d) All the above

66. Final rate of premium is arrived at by loading the pure rate of

premium to provide for

a) Commission to intermediaries

b) Expenses of management

c) Margin for profit

d) All the above three

67. Which of the following is true? No insurer shall assume any risk

unless and until

a) The premium is received in

advance

b) The premium is guaranteed

to be paid

c) A deposit is made in

d) all the above

68. As per IRDA regulations no commission or brokerage can be paid by

insurers exceeding ________% of premium payable in respect of policy

through agents or brokers

a) 10 %

b) 15 %

c) 20%

d) 30 %

69. As per the Insurance Act, 1938 (as amended) an insurer has to

obtain a report form a licensed surveyor if the loss equals or exceeds.

a) Rs.15, 000

b) Rs.20, 000

c) Rs.25, 000

d) Rs.50,000

70. Which of the following are the functions of IRDA?

1. To regulate the rates of premium offered by insurers

2. To regulate investment of funds by insurance companies

a) 1 only

b) 2 only

c) Both are true

d) Neither

71. Which of the following statements is true under Code of conduct for

Agents?

1. The Agent must disclose his license to the prospect on demand

2. The Agent must disclose the scales of commission under policies

offered for sale, if asked by the prospect.

a) 1 is true

b) 2 is true

c) Both are true

d) Both are false

72. As per General Insurance Business (Nationalization) Amendment Act

2002, General Insurance Corporation of India shall carry on.

a) Reinsurance business only

b) Overseas reinsurance

business only

c) Terms and conditions of

insurance

d) All the above

73. Which of the following are the functions of IRDA. To protect the

interests of policyholders in matters of

a) Settlement of claims

b) Fair and equitable rates of

premium

c) Terms and conditions of

premium

d) All the above

74. Under IRDA guidelines which of the following is eligible to become a

corporate agent.

a) A banking company

b) A cooperative society

c) A non- government

organization

d) All of the above

75. As per the Code of Conduct, which of the following is true? The

agent must inform promptly the prospect about

1. The acceptance of the proposal by the insurer

2. The rejection of the proposal by the insurer

a) 1 is true

b) 2 is true

c) Both are true

d) both are false

76. Which of the following statements is true?

1. Corporate insurance executive has to undergo training and pass the

licensing examination.

2. Specified persons’ have to undergo training and pass the licensing

examination

a) 1 is true

b) 2 is true

c) Both are true

d) neither is true

77. Who among the following is eligible to be nominated ‘Corporate

Insurance Executive’ by a corporate agent?

a) A partner (in the case of a

firm)

b) A director (in the case of a

company)

c) One or more of its officers

d) All the above

78. As per IRDA Regulations which of the following is not a function of

Third Party Administrators.

a) Collection of premium

b) Collection of claims

documents

c) Claims scrutiny and

processing

d) Claims payment

79. As per IRDA Regulations a Surveyor has to be appointed within

_____hours/ days of receipt of claim intimation form the insured.

a) 24 hours

b) 72 hours

c) 7 days

d) 15 days

80. Third Party Administrator’s cash less’ service means

a) Admission to a specified

hospital without admission fees

payment

b) Admission to a specified

hospital without deposits

c) Admission to a specified

hospital without payment of

covered expenses of treatment

d) All the above

81. As per IRDA Regulations a Surveyor shall submit the survey report to

the insurer within ______ days of his appointment.

a) 15 days

b) 30 days

c) 45 days

d) 60 days

82. Rejection of claim by the insure shall be communicated to the

insured within a period of ______days form the receipt of the survey

report.

a) 15 days

b) 30 days

c) 45 days

d) 60 days

83. Insurer shall, within a period of _____ days of receipt of survey

repost, offer a settlement of claim to the insured.

a) 15 days

b) 30 days

c) 45 days

d) 60 days

84. Micro-insurance product under IRDA Regulations means

a) A health insurance contract

b) A personal accident contract

c) A livestock insurance contract

d) All the above

85. on acceptance of offer of settlement by the insured. Insurer shall

make the payment within ___days from the date of acceptance of offer.

a) 7 days

b) 10 days

c) 15 days

d) 30 days

86. Which of the following are allowed, under the regulations, to

distribute micro-insurance products?

a) Individual agents

b) Corporate agents

c) Brokers

d) All the above

87. Which of the following statements is true?

1. A life insurer may offer life micro-insurance product as well as general

micro-insurance products.

2. A general insurer may offer general micro- insurance product as also

life micro- insurance products.

a) 1 is true

b) 2 is true

c) Both are true

d) Both are false

88. Micro-insurance product under IRDA Regulations means

a) A non-government

organization

b) a self help group

c) A micro-finance group

d) All the above

89. A District Forum under the Consumer Protection Act can entertain a

complaint where the compensation claimed is less than Rs.

___________ lakhs.

a) 25 lakhs

b) 50 lakhs

c) 75 lakhs

d) 1 crore

90. Consumer Protection Act applies to

a) Private sector

b) Public sector

c) Cooperative sector

d) All the above

91. As per IRDA Regulations, the remuneration to the micro-insurance

agent for non-life insurance business shall not exceed ________% of

premium.

a) 5

b) 10

c) 15

d) 20

92. Which of the following statements is true?

1. State Commission can entertain appeals against the order of the

District Forum.

2. National Commission can entertain appeals against the order of the

State Commission.

a) 1 is true

b) 2 is true

c) Both are true

d) both are false

93. A District Forum under the Consumer Protections Act can entertain a

complaint where the compensation claimed is less than Rs.___ lakhs.

a) 10 lakhs

b) 20 lakhs

c) 30 lakhs

d) 50 lakhs

94. An appeal against the order of the National Commission can be

made within a period of _______ days form the date of order.

a) 30 days

b) 45 days

c) 60 days

d) 90 days

95. Which of the following are grounds for filing a complaint to the

Ombudsman.

a) Insurer had rejected the

complaint

b) Complainant had not

received any reply to his written

representation to the insurer

within on month after receipt of

compliant

c) The complainant is not

satisfied with the insurer’s reply

d) All the above

96. Which of the following statements is true.

1.Redressal of Public Grievances Rules apply to life and general

insurance.

2. These Rules apply to personal lines insurance only.

a) 1 is true

b) 2 is true

c) Both are true

d) Both are false

97. No complaints to the Ombudsman shall lie

a) If the complaint is made later

than one year after the insurer

had rejected the representation

b) If the complaint is pending in

any Consumer Forum

c) If the complaint is subject of

arbitration

d) All the above

98. Which of the following complaints cannot be made to the

Ombudsman?

a) Total repudiation of claim by

insurer

b) Partial repudiation of claim by

insurer

c) Delay in settlement of claims

d) Premium rates are high

99. Which of the following is true as per the Redressal of Public

Grievances Rules?

1. The Award should not be more than Rs. 20 lakh

2. The Awards should be made within three months form the date of

complaint

a) 1 is true

b) 2 is true

c) Both are true

d) both are false

I hope Licentiate sample Paper for Principle of Insurance IC 01 Will help you in cracking the exam on your first attempt. If you want more papers or you want to have a solved paper, Do comment that bellow. Also if you want to share your personal experience of Licentiate, do that as well as I would love to hear that.

Hey thank u so much … For the updates I really liked it .. sample paper of principle of insurance .I still need some other same paper of same subjects. Thank u so much for the help.

Happy to help 🙂

Will be adding more shortly.

Thanks

How to check answer?

Tq

Thanks Buddy! Keep posting the questions. Very helpful.

How can I get the answers

Hi. Where can I get the Answers for the above questions