How To Use RPU For TDS : This tutorial will teach you in detail in how to use Return Preparation Utility (RPU) For Filling 24Q Quarterly TDS (TAX for salaried Employees.) In case you work for an organisation/company where salaried employees are present, Filling for TDS before due date should be at utmost priority for you. The procedure can be tricky, especially for new recruits who have cleared tough examinations in order to get employment in mainstream offices like banks and insurance companies. Tax filing takes place in managerial department like Office services or a separate depart. for handling taxes. In order for you to get your filling processed without errors, the art of using RPU should be known. In this tutorial, we will be looking on exactly the same.

Note : RPU 3.3 Have been released by Tax Authority. Kindly use the same to file taxes from now on.

Note : TDS will be filed only after Tax have been sent to ITR and challan no.s have been Obtained by your organisation.

Note : Last date to submit Q4 TDS (2018-19) is 31st of May. Please submit the FVU before the due date.

ITD have set a regulation regarding filing of TDS (Tax Deducted At Source) for being filed in an In-house software or RPU and submit to TRACES. If any of those words confuse you, keep it together as by the end of this reading session, you will be briefed with everything.

How To Use RPU To File 24Q Tax returns

Most organizations where salaried employees are present, provides a CMS (content management system) where data of employees along with salaries, surcharge, educational cess and tax on salaries are updated each month. Usually such files are in spreadsheet format (Excel) but the can also be in txt depending on where you work.

RPU is ideally used with excel. So, in case you have a text file, you will have to convert it to a spreadsheet. If you already have it in excel, skip what is being told in this step : –

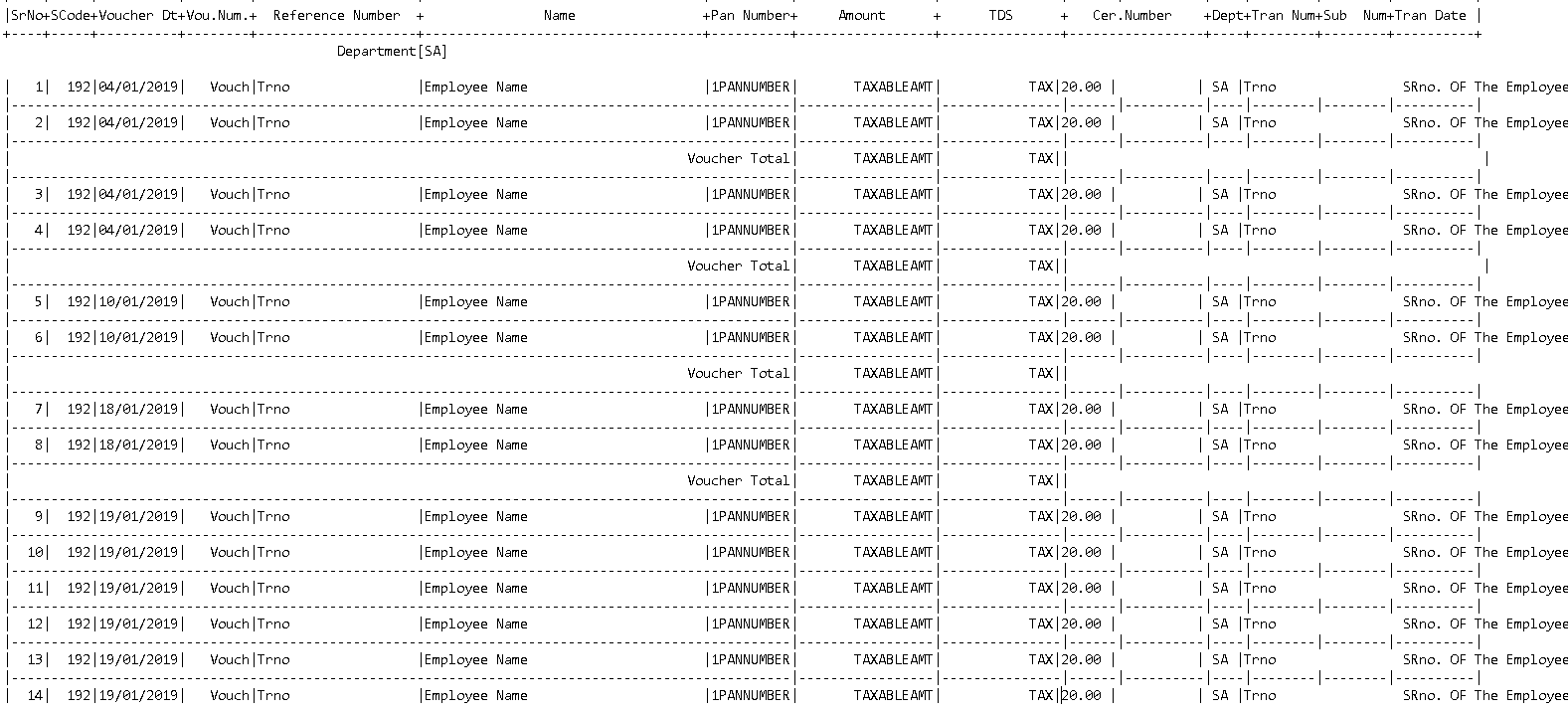

The image shows what a typical monthly data will look like in a text format. Keep that in mind that this is a dummy specimen of what could your CMS can generate. Depending on the variety of job your organisation does, details will vary. But what is mentioned here shall always remain along with other possible additions.

Note : You will have to compile data of 3 Months in order to file for a quarter

If you analyze the image above, you will see that The voucher no and transaction no. will also be available here as the salary paid was an action of accounting. You can use such numbers to identify transactions individually from your office’s account’s section. But while preparing TDS file, these will not be needed.

To eliminate what we don’t need we first convert this to a spreadsheet. For the sake of simplicity, we will be using Microsoft Excel as most work places primarily use it.

Create a new excel spreadsheet and paste all the data you got into it. If the data gets copied on only single column, don’t worry. All you need to do is to determine what data gets in which column. For this, companies give hints in the txt files so that bifurcation can be done easily. Again, look at the image from earlier. There is a “+” Sign at the top of the row appearing frequently. This means that that place is meant to be a column.

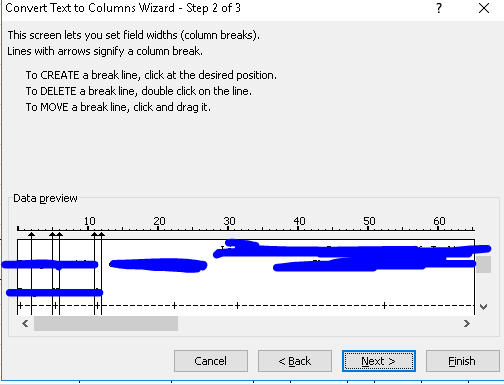

Select the column in excel where all the data have been pasted and tap on “Text to Column option” Under “Data” Section of Microsoft Excel. From here select “Fixed width” and tap on next. You will see this :

After clearing the unnecessary cells, your spread sheet will now be ready to be organised in an ordered manner, as determined by RPU. Let us leave the data as it is for now and start preparing RPU file. It will be easy if we prepare both simultaneously; you’ll see why.

How To Use RPU (how to file tds return for salary)

You can download RPU From Here : https://www.tin-nsdl.com/services/etds-etcs/etds-rpu.html

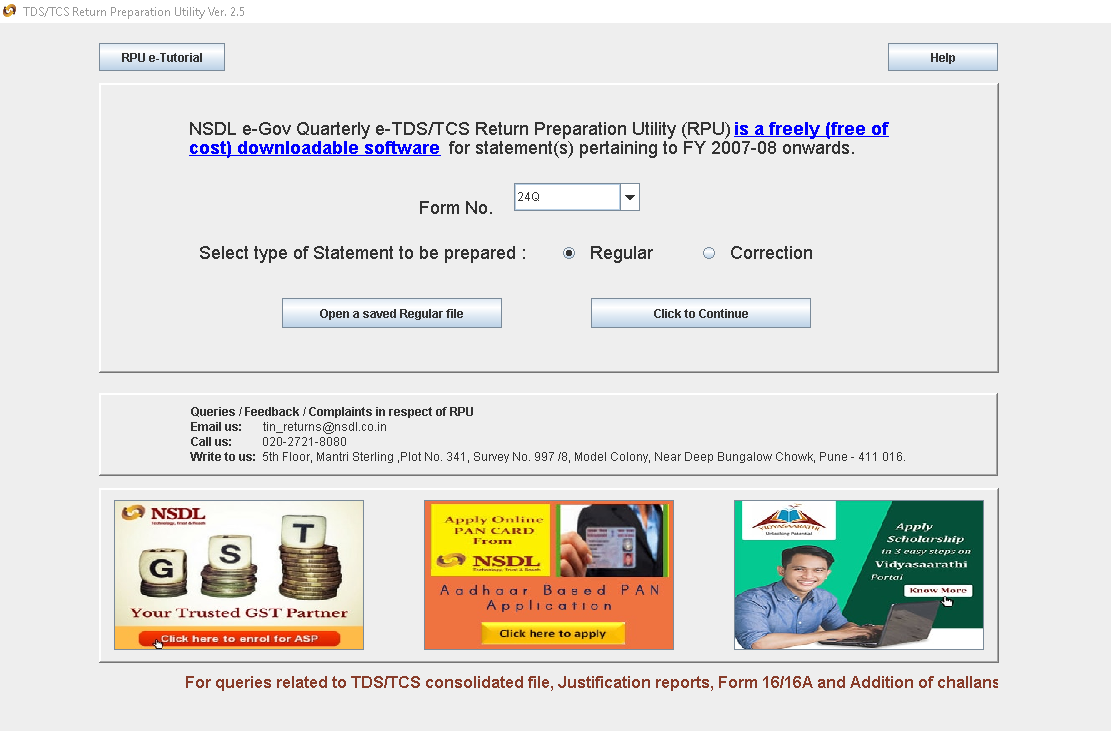

1. Open the latest RPU version after downloading from the link mentioned:

2. Select Form no 24 as that is what we will be talking about here.

Click on continue.

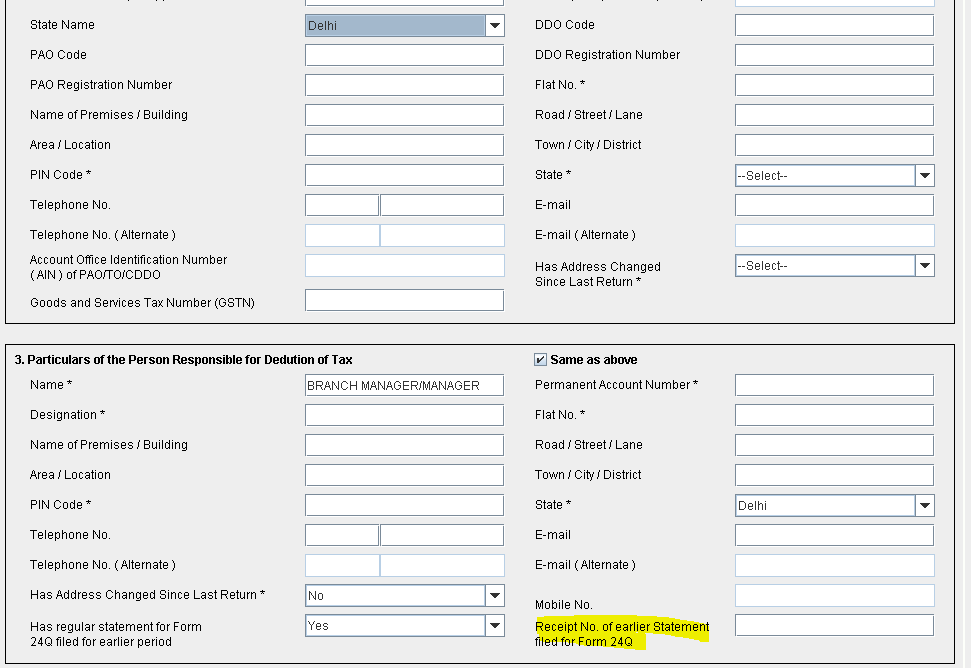

In this menu, fill the simple details asked. Highlighted section asks a receipt no. of earlier statesmen filed. You will get this on the receipt of earlier quarter. It will be mentioned there along with date. DO NOT enter the receipt no. of a correction file, Only main/original file receipts are valid. Fill up the rest of the details. Responsible person here the executive manager/owner of the business premise. For example in a bank’s case, the branch manager shall be deemed as the responsible person, even if he is not the one involved in the filing process.

3. Next Comes the Challan Menu. To put it simply, challan is a voucher where taxes on all salaries under a sec code (e.g. 192B) were paid. So, in a quarterly period, You will have to make 3 challans (usually) for the three different months taxes have been deducted from the salaries. If the first month, 55 employees got paid and deducted their taxes then your first challan will have 55 entries and so on.

We hope that you got the basic idea of Using RPU until the challan section. If you want to have a tutorial on what comes after this, show some interest in the comments down bellow and we will update this with the entire method of filling for 24Q TDS.